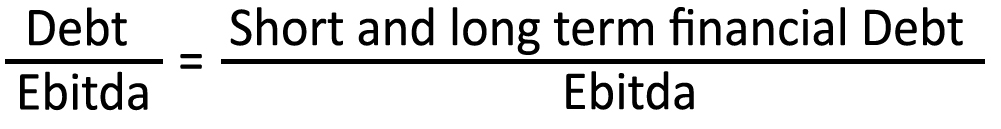

Debt/Ebitda

Debt/Ebitda gauges the time needed for a company to repay its debt, utilizing all potential operating earnings (EBITDA).

it serves as a metric to gauge the company’s debt repayment timeline by utilizing its potential operating earnings (EBITDA). When the Debt/Ebitda ratio is 3, it signifies that dedicating all EBITDA to debt repayment (excluding available cash) would lead to clearing the existing debt in approximately three years.

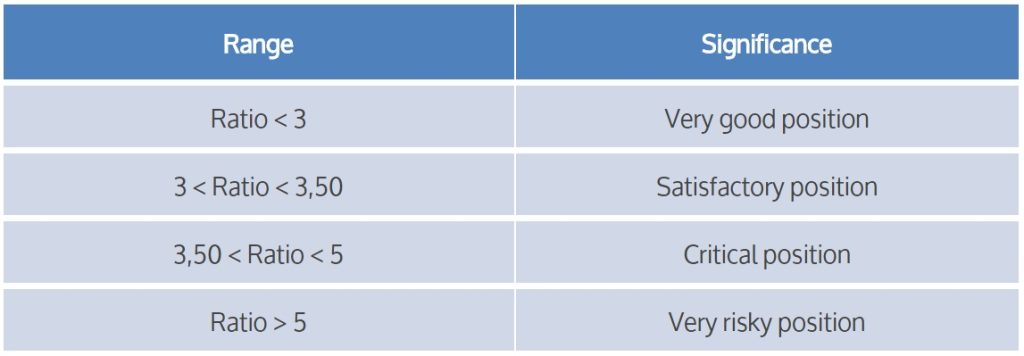

Despite its simplicity, this indicator holds value in evaluating a company’s capability to repay acquired financial resources without losses, proving to be a useful tool. However, there are limitations to its use. EBITDA, being derived from costs and revenues on an accrual basis, assesses economic coverage that may not align with the monetary realization of revenues and expenses.

Caution is warranted when using this indicator to assess operational capacity for generating liquidity to cover financial charges. Its reliability may be limited in this context. Furthermore, even with a balanced Debt/EBITDA index, situations may arise where the company lacks adequate financial coverage. In such cases, insufficient liquidity may compel the company to seek new funding to fulfill due installments, highlighting the importance of considering various financial aspects.

Calculate your Debt/Ebitda

Discover all the features of the software. Request a video call demo with one of our consultants right away.

1 Comment

Comments are closed.

buy cialis online using paypal

02/08/2024buy cialis online using paypal

buy cialis online using paypal