EBIT is an indicator of a company’s profitability, calculated as revenue minus expenses, excluding interest and tax.

EBIT measures the profit a company generates from its operations, for that reason is also called “Operating profit”.

By excluding tax and interest (expenses and income), we focus solely on the company’s ability to generate earnings from operations, ignoring variables such as tax expenses and financial assets.

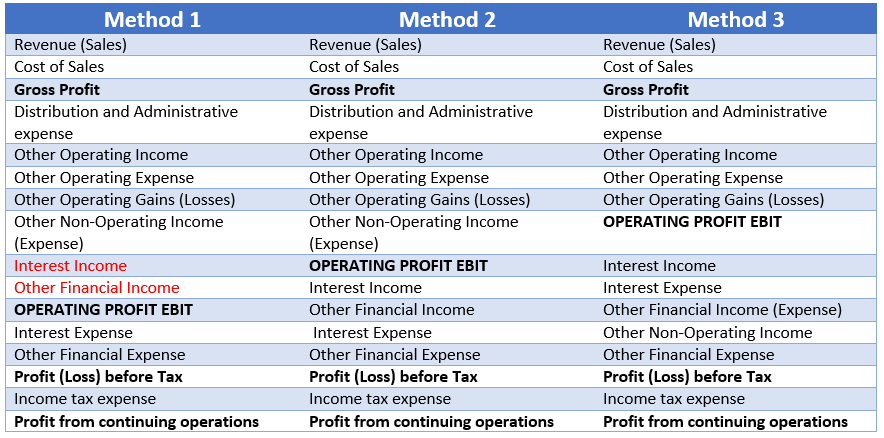

Three different methodologies are commonly used to calculate EBIT:

1: only interest expense and taxes are excluded, while non-operating income (expense) and interest income are included;

2: interest expense, financial income and taxes are excluded, while non-operating income (expense) are included;

3: In addition to interest expense and tax, non-operating income (expense) and interest income are excluded, as well.

In the latter case, EBIT represents the profit deriving from the ordinary business operations of the company. As it does not take into account revenue and costs pertaining to non-typical activities.

For example, consider a company that manufactures steel pipes.

If the company acquires a property and then rents it to third parties, such revenue should not be included in the calculation of EBIT because it does not relate to the typical business. Represented by the production of steel pipes.

But why is it so important to isolate the core/typical business?

It is important because we can this way determine the operating cash-flow, an essential parameter to make a judgment on the core business of the company.

In order to properly evaluate the company’s profitability, in the example above, the question to answer is the following: is the sale of steel pipes profitable? How much profit can I get from it? Naturally, if I did not exclude the profit obtained from the rents, I would get a figure that might not correspond to the real profit that I would get considering only the typical activities.

If you didn’t operate this way, you might have the paradoxical situation that the operating activity, represented by the production of pipes, is at a loss but that this loss is offset by the financial income coming from the rent of properties, which is a business (in the real estate sector) apart from the typical operations (steel pipes). This would lead to a misjudgment of the core business and provide misleading information to the management. On the contrary, being able to highlight the loss from ordinary operations through the exclusion of non-recurring profits, the management can make informed decisions and assess whether the company should better engage only in the real estate business. Why are financial income and expenses also to be excluded? The exclusion of such components is again related to the correct calculation of the operating cash-flow, which should not be influenced by the financial activities.

The error committed in the calculation of EBIT

In our opinion the assumptions defined in Method 2 and Method 3 are both correct, although the best solution would be the one proposed by Method 3, while the solution of Method 1 is wrong.

This error stems from a conceptual and terminological misunderstanding.

In fact, in the acronym EBIT the term “Interest” is mentioned and some authors have mistakenly believed that this term was referring only to the financial expenses and not also to financial income.

This way, in this writer’s opinion, the logic is not correct because what must be excluded from EBIT is the entire financial activity that is comprised of both charges and income.

It would make no sense and logic to exclude financial charges and consider the income instead, as both are related to financial management of the company.

If we wanted to be very thorough, the best solution would be Method 3.

Which excludes not only all the financial area (financial income and expenses) but also non-operating expenses (those that do not relate to the operations of the company).

Unfortunately, however, in practice it is often difficult to know what are the components that do not really relate to the company’s operations or however it might happens that you are not in possession of accurate data so often you cannot help but use Method 2.

Method 1, although used by some authors, does not seem correct for the reasons we have explained above, and in particular for it includes financial income in EBIT.

Three different methods used to calculate EBIT

The importance of the NOPAT

But if we want to use Method 3, the most rigorous, we have to further rectify the EBIT through the calculation of NOPAT, restating the value of taxes and calculating them only on operating profit.

The issue of the so-called Tax on operating profit is described at length in another article to which we refer (see article) and basically consists in considering the additional taxes that would be paid not taking into account the deduction of net finance charges.