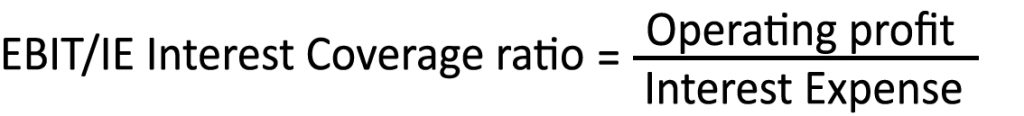

EBIT/IE

The ratio, also called the Interest Coverage Ratio, indicates the degree of coverage that the operating result can provide for the borrowing costs. This indicator is widely used by banks to monitor the financial risk of companies. The ability to meet interest payment obligations is absolutely critical to a company’s relationship with lenders. Because of its importance the index is used by Prof. Damodaran as the only relevant parameter to evaluate the corporate rating.

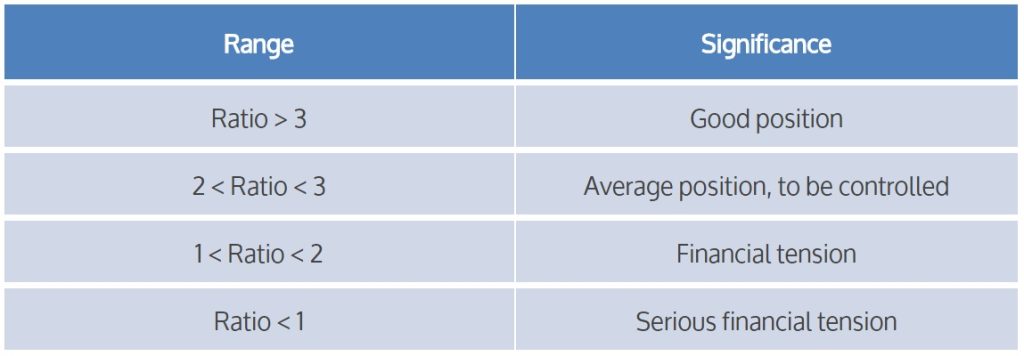

In fact, each value of this indicator is associated with a spread that will result in a given rating. The ratio is particularly useful since it indicates the degree of coverage that the operating income is able to provide for the costs of financial resources. When the index takes on a value less than 1, EBIT will be smaller than financial expenses. If such is the case, the income generated by operating activities is not sufficient to remunerate the capital acquired to produce it.

In that case, unless intervening adjustments result from the extraordinary management (or particularly high dividends and interest income), the final financial result will be negative and the enterprise will find itself in a situation of severe financial stress. Obviously this can only have a negative impact on the judgment of the ratings. The EBIT to Financial costs ratio is very clear and can be used efficiently. The advantage of this index is to analyze jointly the asset size and economic-financial profile. Some financial analysts prefer to use EBITDA/Interest expense ratio, because it is considered more appropriate since EBIT underestimates the cash-flows. Indeed, unlike with EBIT, EBITDA is also formed by the amortization expenses, that do not involve a financial outflow but only a cost and represent a kind of financial surplus for the enterprise used at any time.

However, although this approach is not wrong, for a company with ongoing activity it is dangerous to depend on the cash-flows generated by non-cash items such as amortization to meet its debt payments. Let us not forget that firms with high costs for amortization usually have significant capital expenditures. If the cash-flows associated with amortization expenses are used to make debt payments, the company may not have the funds to be invested to support future growth or to keep the processes in place. An enterprise with a high EBITDA and a low EBIT that borrows resources based on the estimate of the former value may be in serious trouble for two reasons:

i) using the cash-flow generated by the amortization to repay borrowing instead of making capital expenditures can endanger his prospects of growth;

ii) if it continues to make capital expenditures, they will have to depend on new funding to cover the costs of debt.

EBIT OR EBITDA

For that reason we prefer to use EBIT rather than EBITDA when testing the sustainability of debt cost.