For assessing the profitability of a financial plan, the most used quantities are the NPV and the IRR. The Net Present Value (NPV) is defined as the present value of the sum of the discounted cash-flows throughout the duration of the financial plan. This indicator represents the wealth created through the project, updated to the date of reference.

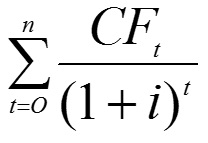

The NPV calculation is done through the application of the following mathematical formula:

where:

CFt = expected cash flow in year t;

i = rate of interest used to discount the future cash flows;

n = number of years considered.

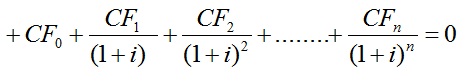

If the NPV is positive, the project is acceptable. The IRR (Internal Rate of Return) of the project is that rate at which the NPV is zero. The IRR therefore represents the maximum cost that the sponsors are available to incur to make the investment.

The definition of the appropriate discount rate to be applied is very complex: it should reflect the riskiness of the project and significantly affects the amount of it. Must also take into account the cash flow configuration that you use as an operating cash-flow must be discounted at a rate which reflects the weighted average cost of capital. In contrast, the net cash-flow will be discounted using a discount rate which refers to the Equity only.