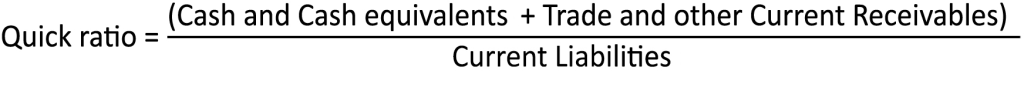

The quick ratio, also known as the acid-test ratio, is a financial metric that evaluates a company’s short-term solvency. Unlike the current ratio, the quick ratio excludes inventories from its calculation, focusing solely on cash and equivalents, as well as trade and other receivables. By doing so, it provides a more immediate assessment of a company’s ability to meet its short-term obligations without relying on the sale of inventory.

This ratio is particularly useful in situations where the value of a company’s inventory may be subject to fluctuations or uncertainties in valuation. By excluding inventory, it addresses the potential issues related to inventory valuation that can impact the current ratio. In doing so, it offers a more conservative measure of a company’s liquidity.

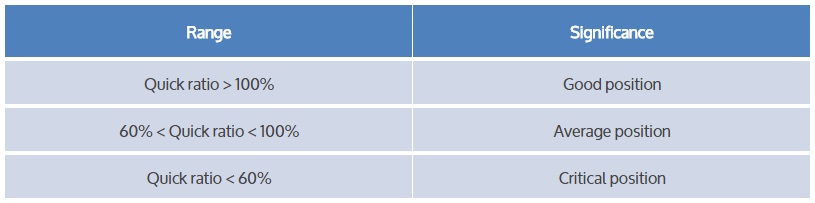

This value of 1 or higher is generally considered favorable, indicating that a company possesses enough liquid assets to cover its short-term liabilities. Conversely, a quick ratio below 1 suggests potential difficulties in meeting immediate financial obligations.

In summary, the quick ratio is a valuable tool for assessing a company’s immediate solvency, providing insights into its ability to cover short-term liabilities without relying on inventory sales. This metric offers a more conservative approach compared to the current ratio, making it especially relevant in situations where inventory valuation may introduce uncertainties.