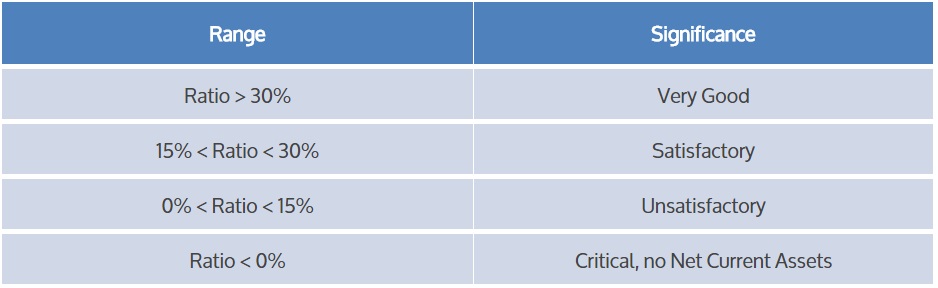

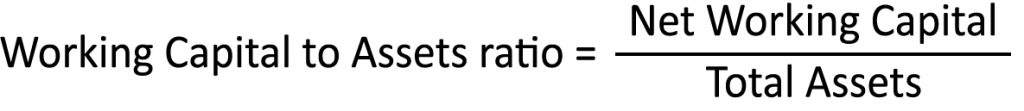

The working capital to total assets ratio evaluates short-term solvency by comparing net liquid assets to the total assets of a company, serving as a critical financial metric.

Working capital, the gap between current assets and liabilities, is pivotal in assessing a company’s capability to fulfill its immediate financial commitments.

This ratio is a crucial financial health indicator, disclosing the company’s ability to meet short-term liabilities by utilizing its current assets. A higher ratio implies a stronger ability to meet immediate financial obligations, suggesting sound liquidity management.

Investors and analysts utilize the ratio to total assets to assess a company’s operational efficiency and its capacity to handle short-term financial obligations.

A well-managed it ensures that a company has sufficient resources to cover its day-to-day operational needs without relying heavily on external financing.

Additionally, a lower ratio may indicate potential liquidity challenges, emphasizing the need for careful financial management to avoid disruptions in daily operations.

Maintaining the correct working capital balance is crucial, guaranteeing sufficient liquidity without immobilizing excessive funds, allowing for potential growth or investment returns.

In summary, the working capital to total assets ratio is a critical financial metric providing insights into a company’s short-term solvency and liquidity management.

A comprehensive grasp of this ratio empowers stakeholders to make informed decisions on the company’s financial health, operational efficiency, and handling of short-term financial challenges.